When you first think of the consequences of rising interest rates, you could naturally conclude that would drive real estate prices down. Over the long haul, you would be right. However, when you look at what is going on now as rates are rising, you might be shocked to see that both rates and prices are rising together.

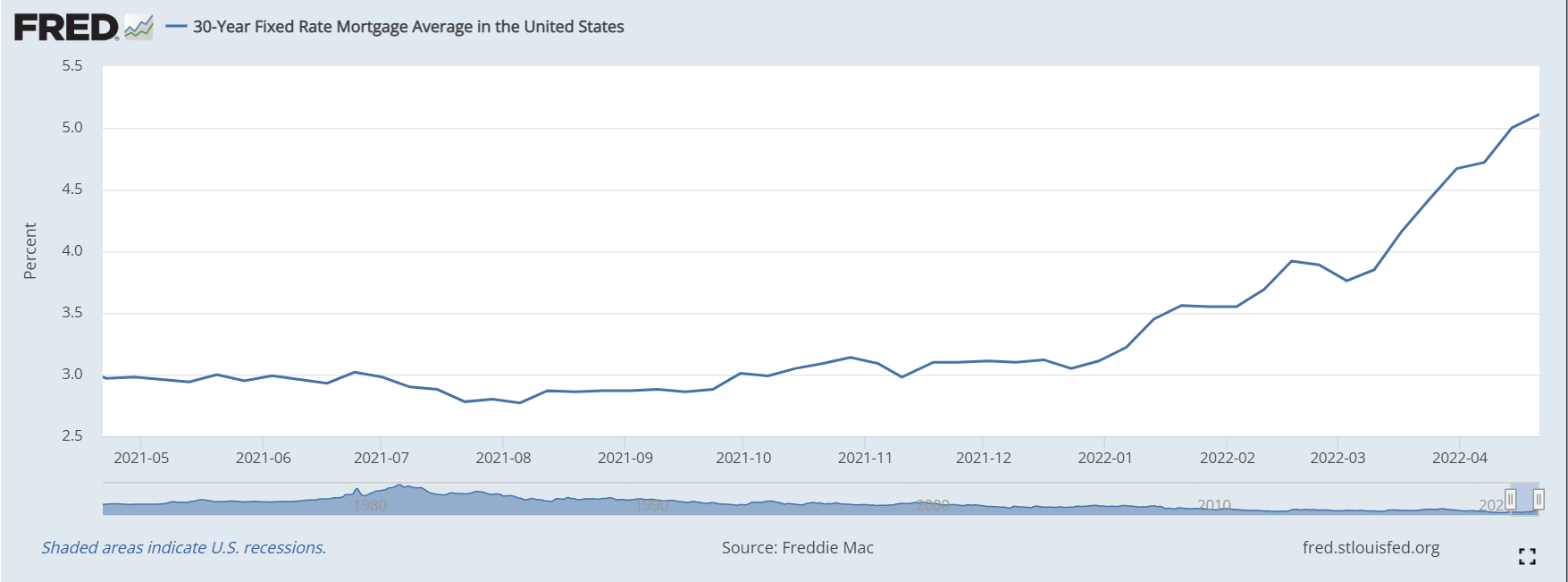

Mortgage rates have been increasing steadily since the begging of the year 2022. At the beginning of the year, mortgage rates were right around 3.2%. As of the end of April 2022, mortgage rates have risen to around 5.2%. Some resources are show as high as 6.1% as of this writing.

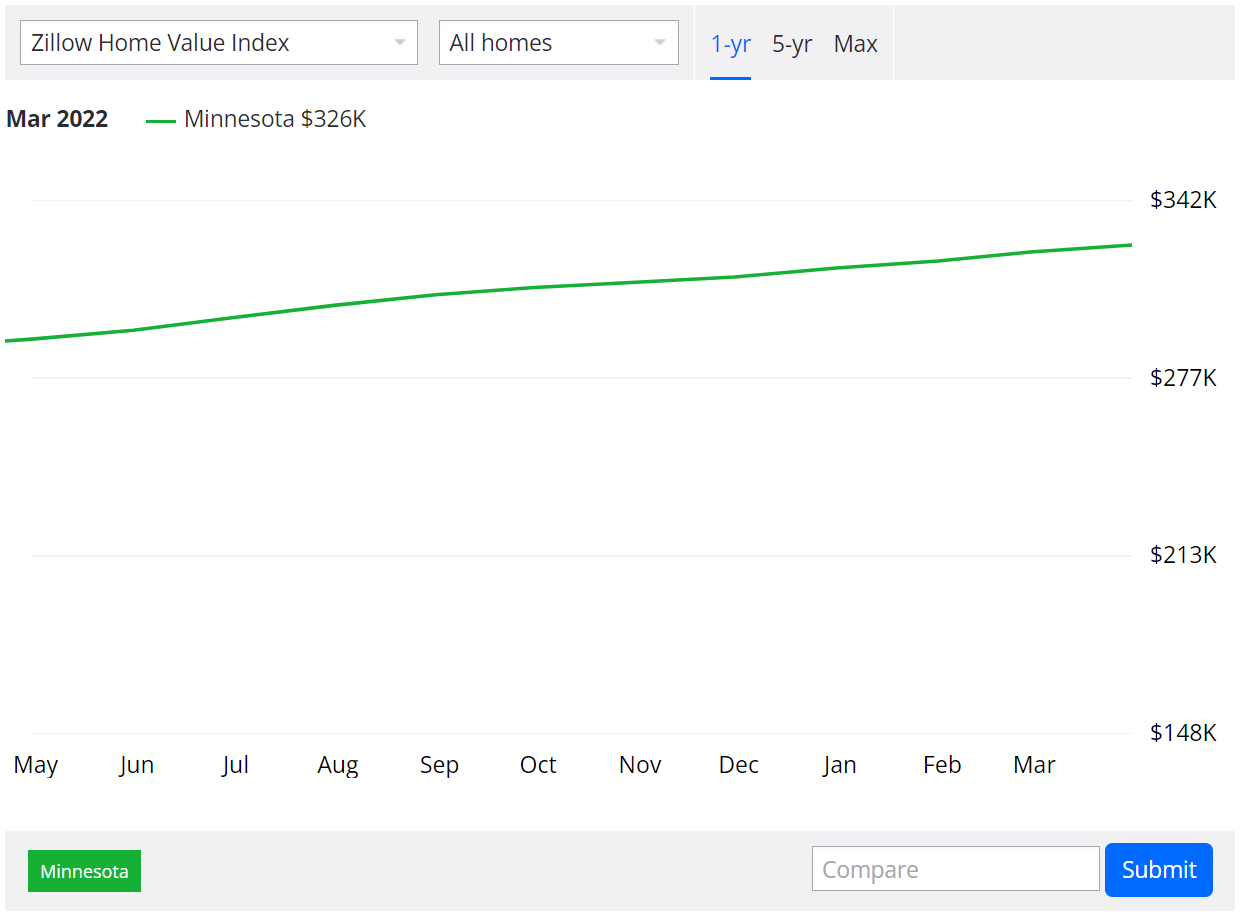

The interesting thing is that the median sales price for real estate is also increasing. The median home values of Minnesota, my home state is currently $326k, the twin cities metro area is a little higher at $340k.

So why are prices still increasing at the same time interest rates are also increasing. To explain that you need to have a little understanding of economics. In the simplest form, when supply is high and demand is low, rates tend to drop lower to encourage borrowing. This is one of the tools that the federal reserve uses to spur growth in the economy. On the flip side, when inflation is out of control, like it is now, rates tend to rise to keep up with inflation which usually slows borrowing which in turn lowers demand on products which in theory increases supply over time which will bring inflation down.

That is what is happening right now. When interest rates start rising, fewer buyers will be able to qualify for loans. However, the inventory levels are so low that the demand is at an all-time high. If interest rates were not rising, then the median home values would have been rising even higher than they are now. The rising interest rates is what is holding the median home values lower than they naturally would have been if the interest rates would have remained low. Eventually things will even out, and the median sales prices will come down relative to current housing affordability levels.