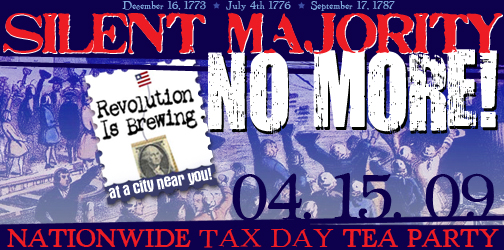

Tomorrow is the BIG DAY. There will be Tax Day Tea Parties all around the country. Will you be there? If you are like me and agree that government spending has gone completely out of control with no oversight and you don’t like the thought of your children’s grand children paying for this governments spending, then you will be there.

Tomorrow is the BIG DAY. There will be Tax Day Tea Parties all around the country. Will you be there? If you are like me and agree that government spending has gone completely out of control with no oversight and you don’t like the thought of your children’s grand children paying for this governments spending, then you will be there.

April 15th is the one time a year when most people actually look at what they pay in taxes annually. While I am not against taxes in general, I am against taxation without representation, just like our fore fathers were. It has been over 200 years since the original Boston Tea Party in 1773.

President Obama even said that it was the government’s job to spend money because we the people are not and can’t afford to spend money. Then the question begs to be asked. “If we can’t afford to spend the money, then how are we going to be able to spend the money”?

Maybe it is just me, but it seems that since we can’t afford to spend the money right now, that maybe we should try and get our financials back in good shape so that we can start spending money ASAP. I also thought that spending money that we don’t have is what got us into this mess in the first place.

Maybe it is just me, but it seems that since we can’t afford to spend the money right now, that maybe we should try and get our financials back in good shape so that we can start spending money ASAP. I also thought that spending money that we don’t have is what got us into this mess in the first place.

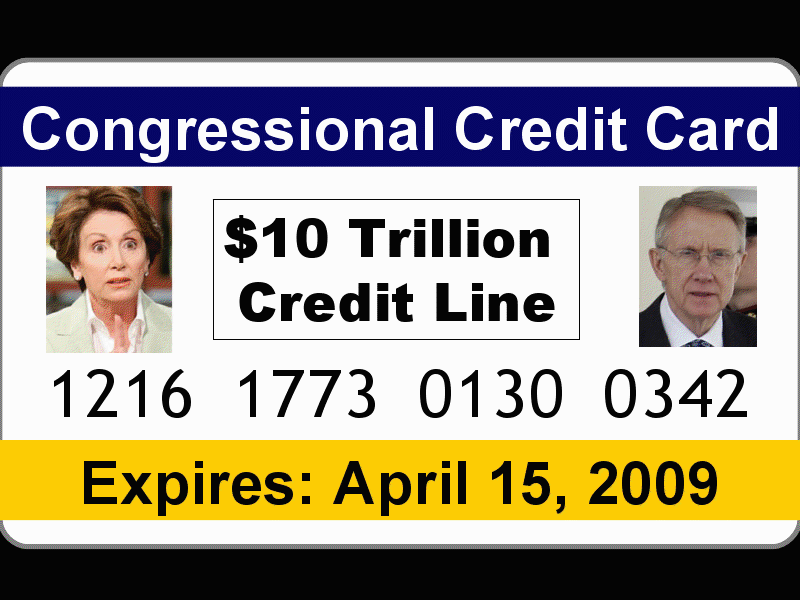

The Tax Day Tea Parties is designed so that congress hears us. Maybe if they do, they might start reading the spending bills that President Obama, Nancy Pelosi and Harry Reid have them vote yes for and maybe even repeal the 2009 Stimulus Pl ... Read More…