Happy Monday!

MnREIA is the largest REIA in the Upper Midwest and Voted #1 in Minnesota by the Top Leaders and National Speakers in the Country!!

MnREIA is a community of real estate investors that strive to provide the most current, relevant, and fresh training from the top leaders in the real estate industry.

Our main monthly meetings take place on the first Tuesday night of each month. We also have 12 other subgroups to attend each month with different speakers, topics, locations, days and times to meet the needs of new and seasoned investors and everyone in between.

Whether your passion is flipping, short-term rentals, buy and hold, wholesaling, commercial, residential, property management, single-family, multi-family, mobile homes, storage units, sales and marketing, lending, foreclosures, development, agent, broker, insurance, construction, or any other support roles, you will fit right into our community of real estate investors!

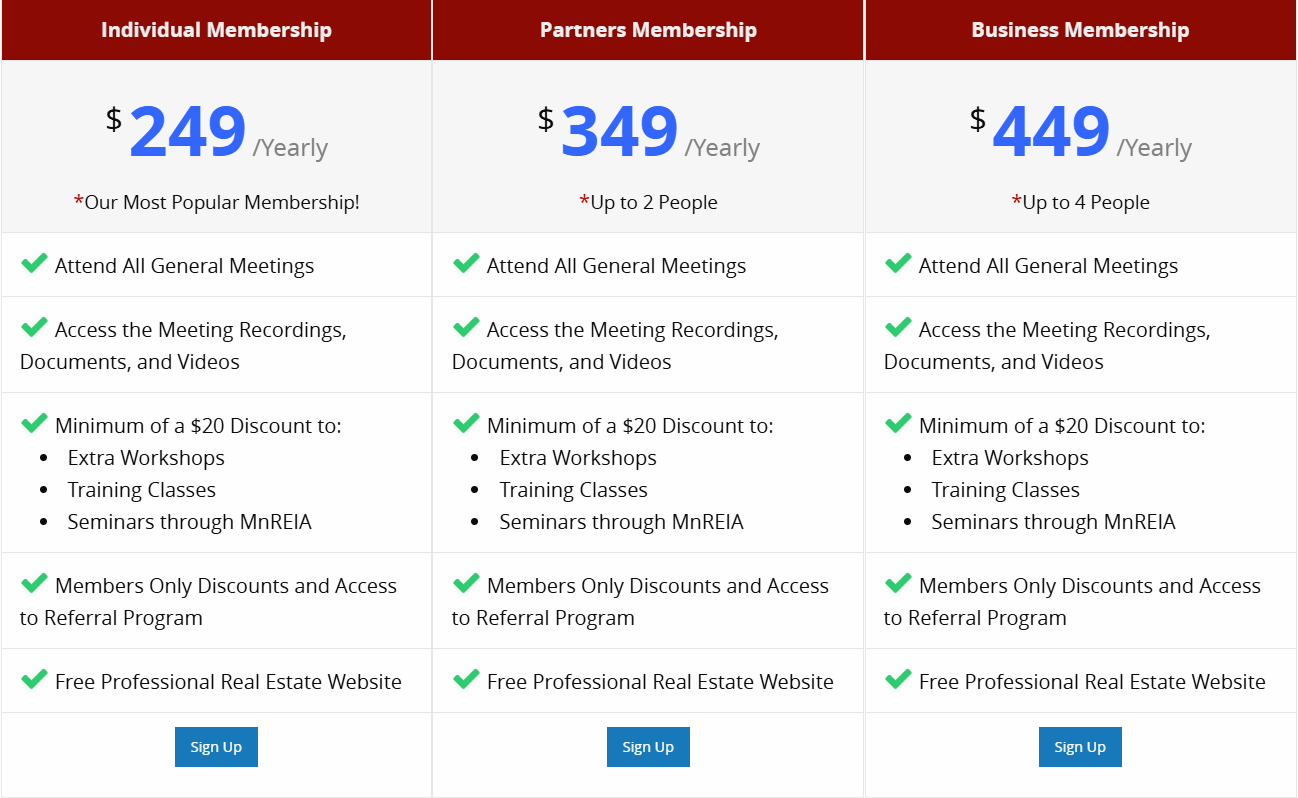

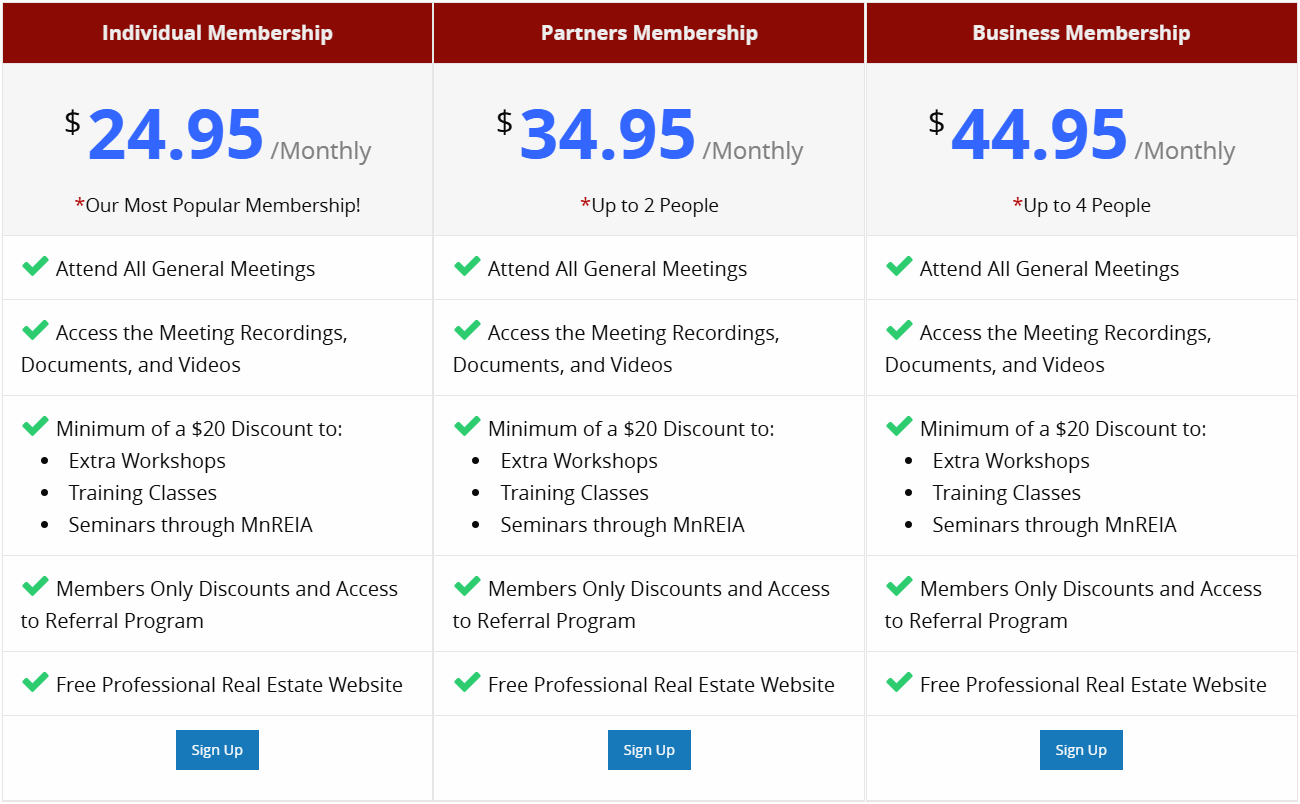

Check out the Monthly and Yearly memberships we offer through MnREIA:

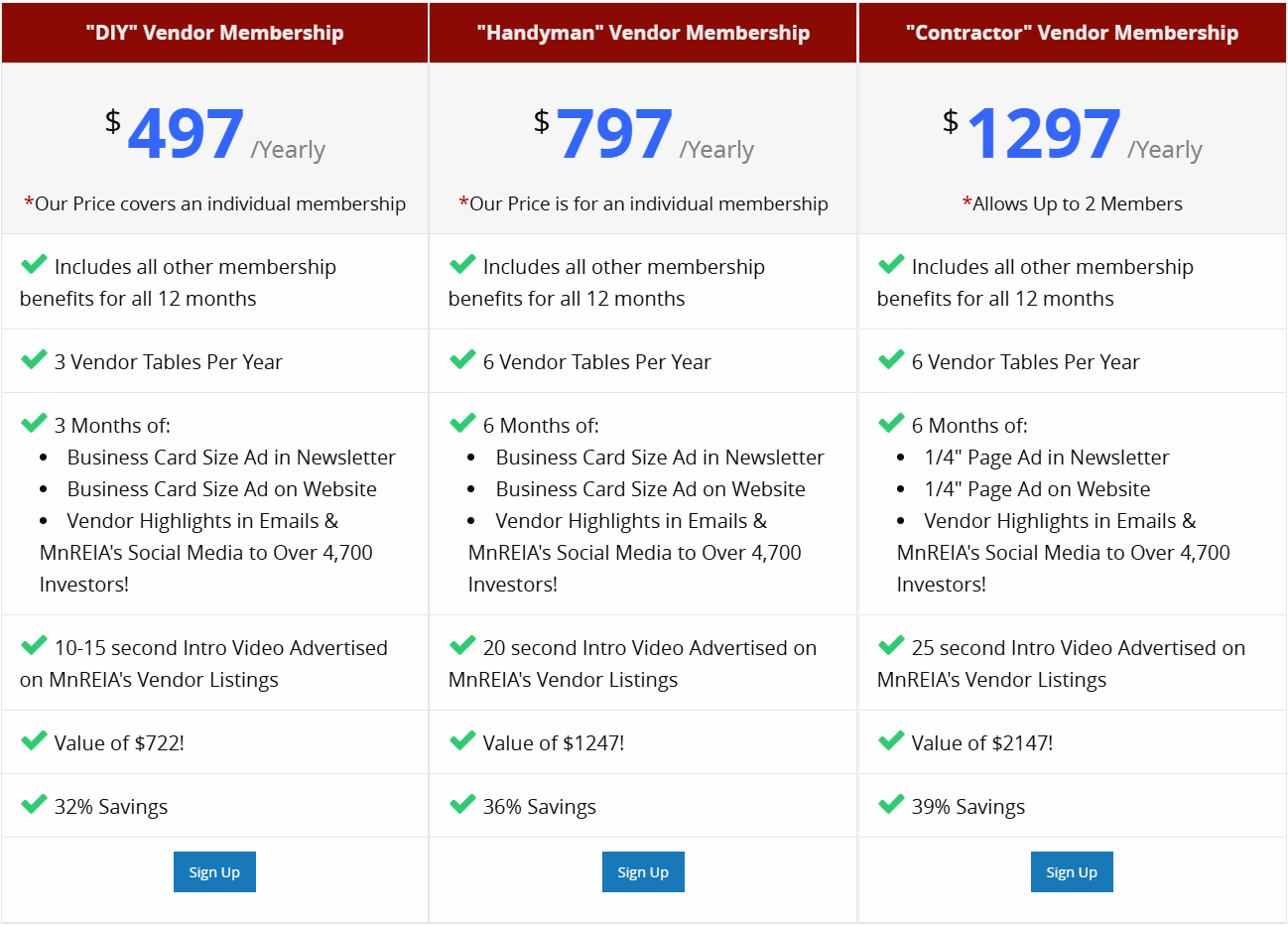

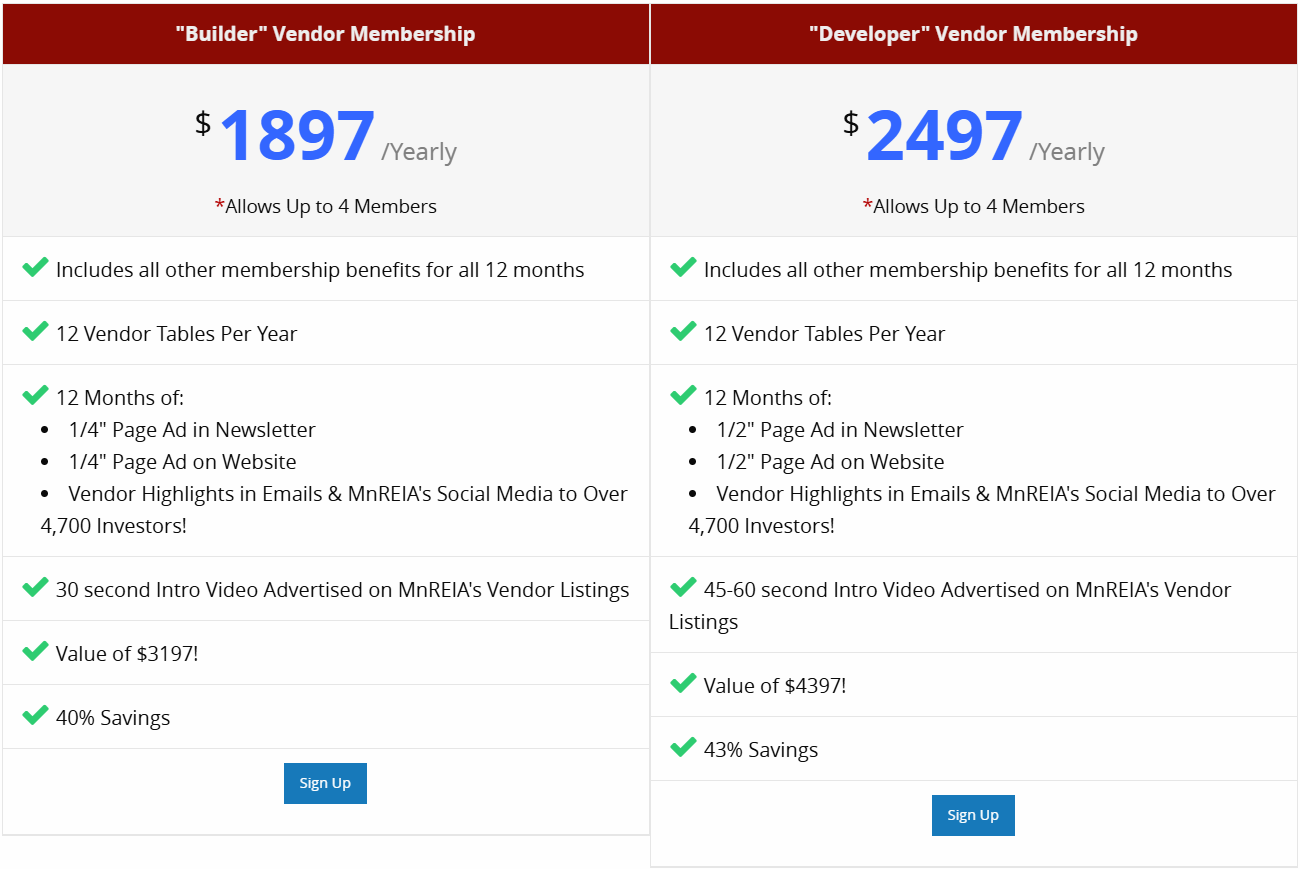

Interested in Becoming a Valued Vendor Member? Check Out the 5 Vendor Packages we Offer!

Take advantage of our Thanksgiving Promotion and Receive $50.00 OFF any Membership of $100 or More!

Just Enter Promo Code Thanksgiving2024 from 11/22/24-12/1/24 at Checkout!

If you haven’t attended a main meeting before, please come as our guest at no charge to ... Read More…