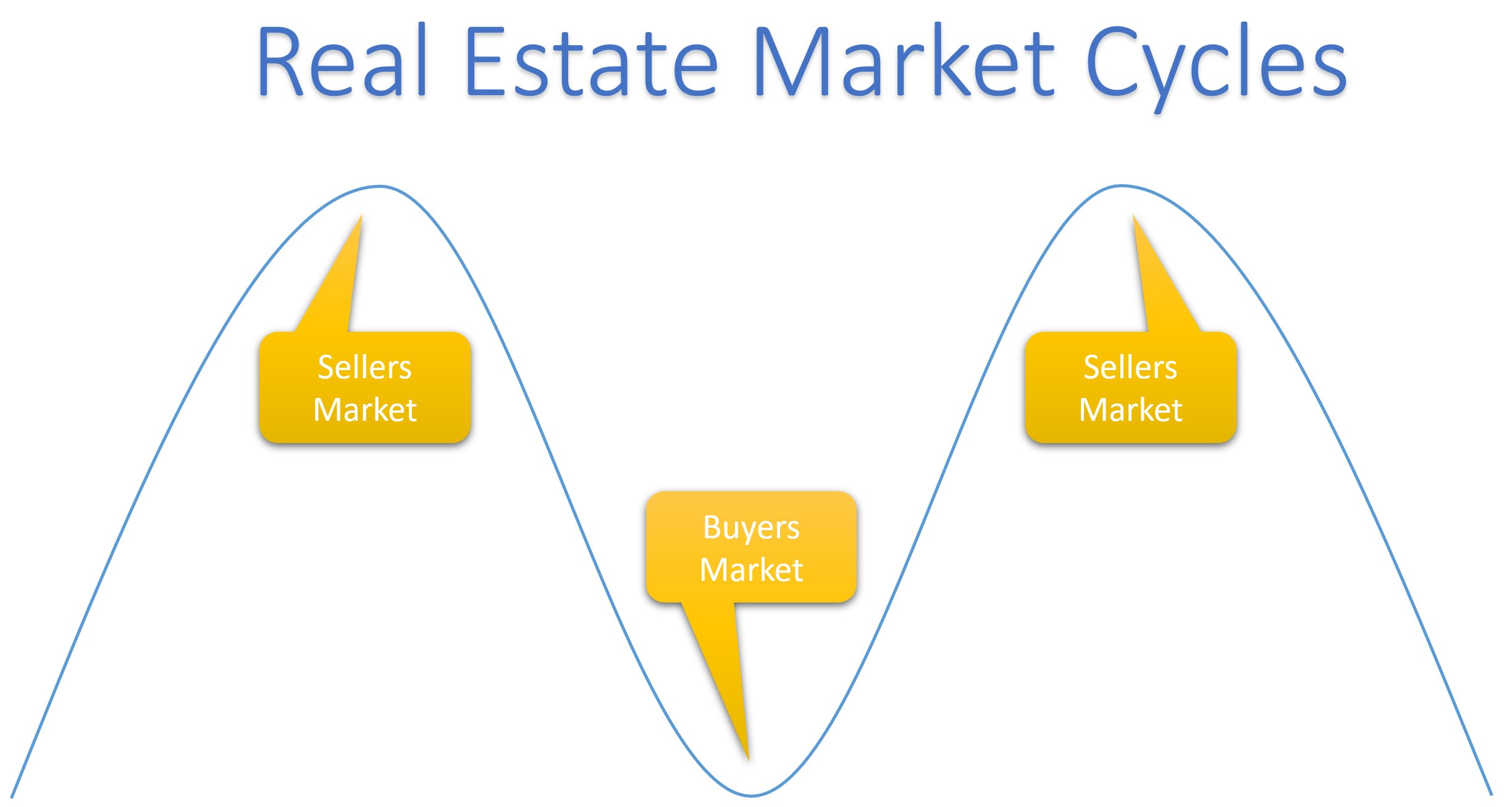

25% of all listing had a price reduction last month and inventory levels are rising. We are still in a sellers’ market, but we are transitioning into a buyers’ market. When that happens, sellers buyers become picking and stubborn sellers slowly become more receptive. The first phase of this transition is for sellers to drop their asking prices, and that is starting to happen.

The next phase, if interest rates remain high, will shock the sellers and if they have to sell, they will drastically drop their price to get a sale and that has a snowball affect on prices. The only thing that can help the sellers now is for inventory levels to remain low and interest rates to drop a little.

The next phase, if interest rates remain high, will shock the sellers and if they have to sell, they will drastically drop their price to get a sale and that has a snowball affect on prices. The only thing that can help the sellers now is for inventory levels to remain low and interest rates to drop a little.

...

Read More…