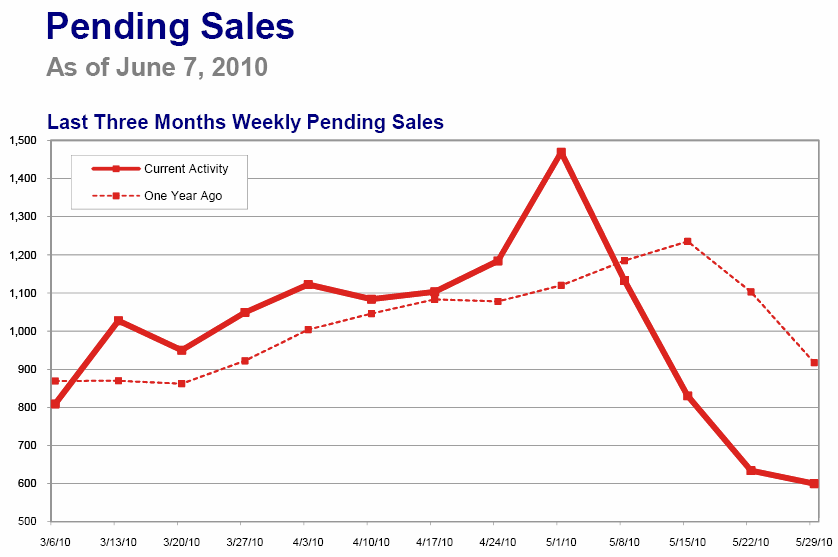

Look at the drop starting on May 1st. This graph should be all you need to realize that the first time home buyers tax credit drove a lot of sales at the moment, but they would be sales that were pulled forward. In other words, if the tax credit wasn’t there, the sales would probably still have happened, but they would have been spread out over time rather than pushed back into April.

First of all, the banks are short staffed, so they can’t file NOD (Notice of Defaults) and complete the foreclosure process as fast as new borrowers are falling into default. The average borrower in foreclosure has been delinquent for 438 days before actually being evicted, up from 251 days in January 2008, according to LPS Applied Analytics. That is the first part to Shadow Inventory.

Click To Enlarge

This has also created other problems. I had a closing that kept getting pushed back because FHA hadn’t review the file to release the funds because they were so backed up. We finally closed last week and from talking to the buyers at the closing, they just wanted to close before they lost the credit, but it wouldn’t have stopped them from buying, they just bought now rather then this summer when they originally planned on moving.